Direct Card API 💳

Cards via API - gives businesses access to our APIs so they can design a payment experience for card payments that fits their brand identity, user experience objectives, and particular business needs. Businesses can leverage this to create seamless user experience consistent with their brand.

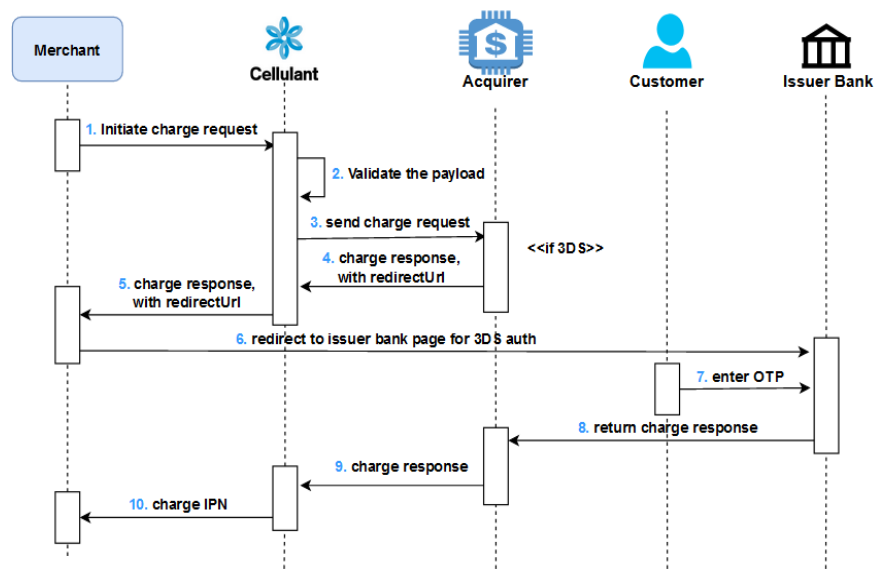

Sequence Diagram

Direct Card Sequence Flow

- Merchant invokes the card API to charge the customer's card.

- Card API will receive the request and validate the payload parameters.

- If the validation passes, Cellulant card processor will formulate and send the request to the acquirer to charge the card.

- Acquirer will receive and validate the charge request from Cellulant. If the payment requires 3DS authentication, the acquirer will return a response to Cellulant with a bank Issuer redirect page for the customer to authorize the payment.

- Cellulant will receive a response from the acquirer with a redirect page (or redirect Url) and forward it to the merchant.

- Merchant will load the page to the customer and prompt the customer to enter OTP/bank security code to authorize the payment.

- The customer will enter the OTP to authorize the payment.

- After a customer enters the OTP, the bank will send the final status to the acquirer.

- Acquirer will receive the response from the bank and forward it to Cellulant.

- Cellulant will receive the callback from the acquirer and send an IPN to the merchant with the final status of the payment.

- Merchant should display the page with the final status received on the IPN.

Updated 8 months ago